The Digital Revolution in Finance

The financial sector has undergone a remarkable transformation over the past few decades, driven by rapid technological advancements. From the early computerization of trading systems in the 1980s to today's blockchain-powered decentralized finance, technology continues to reshape how we interact with money and financial services.

This page explores key technological trends that are influencing the evolution of financial services, providing context and educational insights into how these innovations work and their potential impact on the future of finance.

Key Technological Trends

Blockchain Technology

Distributed ledger systems that enable secure, transparent transactions without centralized intermediaries. Beyond cryptocurrencies, blockchain applications include smart contracts, decentralized finance, and improved clearing and settlement systems.

Artificial Intelligence

Machine learning algorithms that analyze vast datasets to identify patterns, predict market movements, detect fraud, automate customer service, and optimize investment portfolios with unprecedented efficiency and accuracy.

Digital Banking

The shift from traditional brick-and-mortar banking to mobile-first financial services, offering convenient, 24/7 access to accounts, payments, and financial management tools with enhanced user experiences.

Historical Perspective

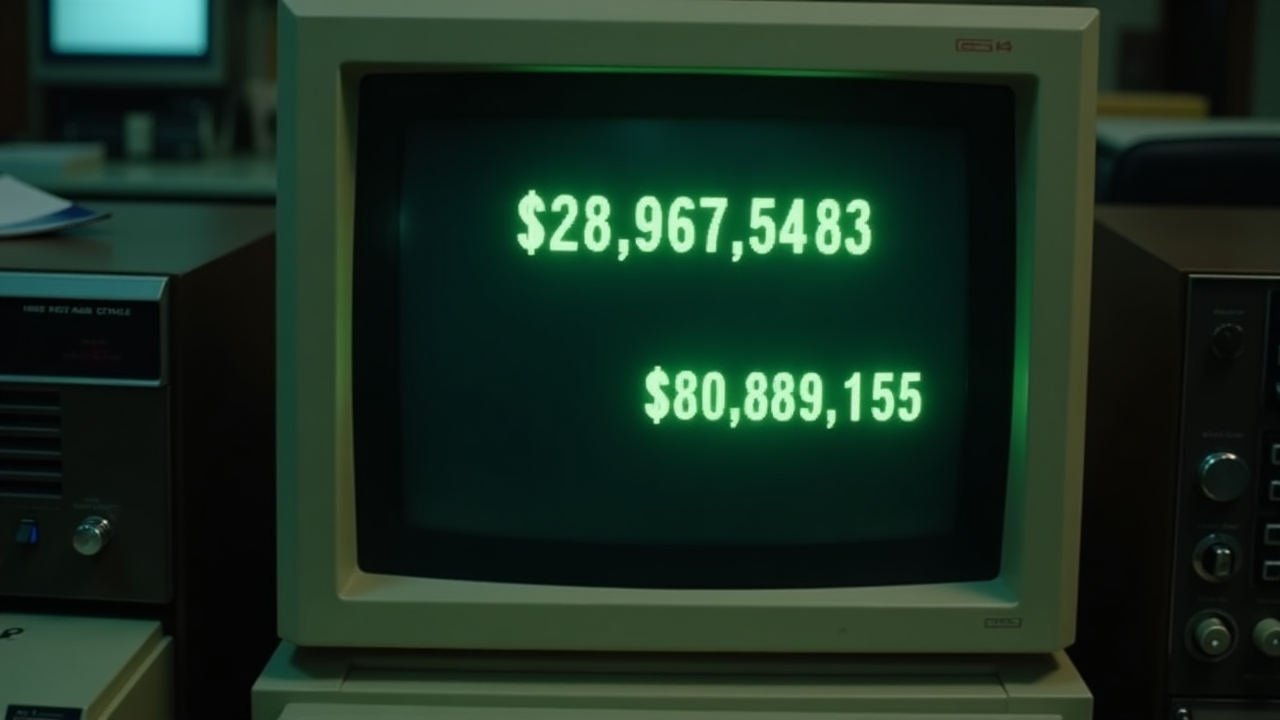

From Analog to Digital: The 80s Revolution

The 1980s marked a pivotal transition in financial technology. The introduction of computerized trading systems, early ATMs, and electronic payment networks laid the groundwork for today's sophisticated financial infrastructure.

During this era, financial institutions began digitizing their operations, replacing paper-based processes with computer systems that could handle transactions more efficiently. The New York Stock Exchange introduced its "DOT" (Designated Order Turnaround) system, allowing brokers to route orders electronically.

This period also saw the emergence of early financial databases and information systems that would eventually evolve into the real-time market data platforms we rely on today.

Emerging Technologies

Quantum Computing

Exploring how quantum computing could revolutionize financial modeling, risk assessment, and cryptography by solving complex calculations exponentially faster than classical computers.

Financial institutions are researching quantum algorithms that could optimize trading strategies, enhance encryption methods, and create more accurate predictive models for market behavior.

Advanced Analytics

Understanding how big data analytics and predictive modeling are transforming financial decision-making processes by uncovering hidden patterns and relationships.

These technologies enable more personalized financial products, improved risk management, and more accurate market forecasting by processing and analyzing vast amounts of structured and unstructured data.

Extended Reality

Discovering how virtual and augmented reality technologies are creating new ways to visualize financial data, conduct remote meetings, and provide immersive customer experiences.

Financial education, training, and complex data interpretation can all benefit from these immersive technologies that blend digital information with the physical world.

Fintech Innovation Landscape

The Rise of Financial Technology Startups

Fintech companies have dramatically reshaped the financial services industry by introducing innovative solutions that address specific pain points in traditional banking, investing, and payment systems.

These technology-driven firms typically focus on creating user-friendly interfaces, reducing costs, increasing accessibility, and providing specialized services that traditional financial institutions might overlook or implement more slowly.

The fintech ecosystem now includes:

- Payment processing innovations

- Digital lending platforms

- Automated investment advisors

- Personal finance management tools

- Insurance technology solutions

- Regulatory technology systems

Regulatory Technology (RegTech)

How Technology Is Transforming Compliance

Financial regulations have grown increasingly complex in the wake of the 2008 financial crisis. RegTech refers to the use of innovative technologies to address regulatory challenges in the financial sector more effectively and efficiently.

Automated Reporting

Systems that automatically gather, process, and submit required regulatory reports, reducing manual effort and the risk of errors while ensuring timely compliance.

Risk Monitoring

Advanced analytics tools that continuously monitor transactions and activities for potential risks, flagging suspicious behavior in real-time before it becomes problematic.

Identity Verification

Biometric and digital identity solutions that streamline Know Your Customer (KYC) processes while providing stronger security and reducing fraud risks.

Future Outlook

The pace of technological innovation in finance shows no signs of slowing. Looking ahead, we can anticipate several key developments that will likely shape the future of financial services:

Financial Inclusion

Technology will continue to expand access to financial services for underserved populations globally, particularly through mobile banking and simplified digital onboarding processes.

Enhanced Security

Advanced biometrics, behavioral analysis, and quantum-resistant cryptography will develop to counter increasingly sophisticated cyber threats to financial systems.

Cognitive Finance

AI systems will become more autonomous in making financial decisions, with transparent algorithms that can explain their reasoning to human overseers.

While these technological advancements offer tremendous opportunities, they also present challenges related to privacy, security, regulatory oversight, and ensuring that innovation benefits society broadly rather than exacerbating existing inequalities.

The most successful financial institutions will be those that can effectively balance technological innovation with human expertise, ethical considerations, and regulatory compliance.

Educational Resources

Learning About Financial Technology

Interested in deepening your understanding of financial technology? Consider exploring these educational avenues:

Books & Publications

- The Financial Technology Handbook

- Digital Finance: Security Tokens and Beyond

- Blockchain Basics: A Non-Technical Introduction

- The AI Revolution in Banking

Online Courses

- Introduction to Financial Technology

- Blockchain Fundamentals

- AI Applications in Finance

- Digital Banking Transformation

- Cybersecurity in Financial Services

Podcasts & Webinars

- Fintech Insider

- Breaking Banks

- The Blockchain Show

- Digital Finance Analytics

- Wharton Fintech Podcast