Our Mission

RetroFinance Insights was established with a clear vision: to make financial knowledge accessible, engaging, and relevant for everyone. We believe that understanding financial concepts shouldn't be limited to professionals in the industry but should be available to anyone interested in enhancing their financial literacy.

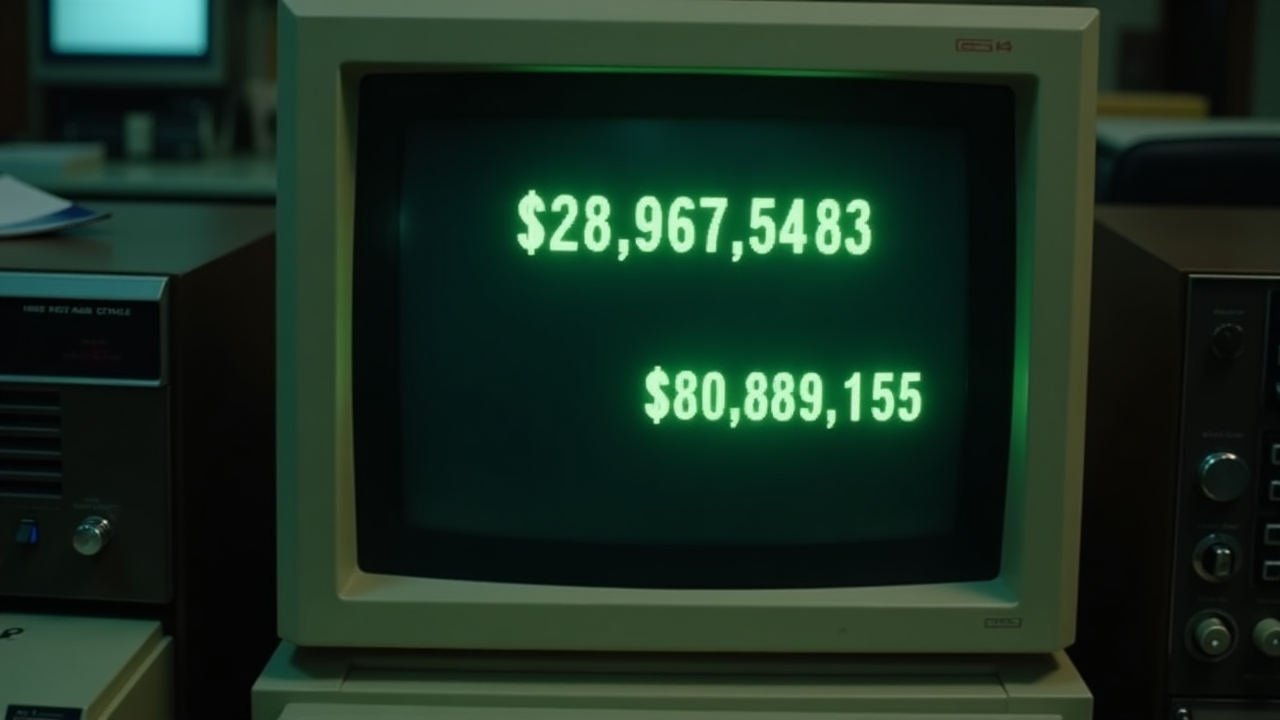

Our unique approach combines nostalgic retro aesthetics with contemporary financial education, creating an engaging platform where complex concepts are presented in an approachable and memorable way. By bridging the gap between traditional finance and modern technology, we aim to provide educational content that resonates with both seasoned professionals and newcomers to the financial world.

Core Values

- Educational Focus: Providing clear, accurate, and informative content that enhances financial understanding

- Accessibility: Making complex financial concepts understandable for diverse audiences

- Innovation: Exploring the intersection of traditional finance and emerging technologies

- Engagement: Creating visually distinctive content that captures attention and promotes learning

- Integrity: Maintaining objectivity and educational purpose in all our content

Our Story

The Concept

RetroFinance Insights began as a concept to create a unique educational platform that would stand out in the crowded financial information space. We identified a gap between traditional financial education and the growing interest in financial technology.

Development Phase

Our team spent a year researching and developing our distinctive retro-inspired approach to financial education. We focused on creating a visual identity and content strategy that would make complex financial concepts more approachable and engaging.

Digital Launch

RetroFinance Insights officially launched as a digital platform, offering educational content on financial fundamentals with our signature retro aesthetic. Despite the global challenges of 2020, we found an audience hungry for accessible financial information.

Technology Focus

We expanded our content to include more in-depth coverage of financial technology trends, recognizing the growing importance of digital innovation in the financial sector. This included educational materials on blockchain, AI in finance, and digital banking.

Community Growth

Our audience grew substantially as more people sought reliable information about evolving financial technologies and fundamentals. We focused on building a community of financially curious individuals from diverse backgrounds.

Present Day

Today, RetroFinance Insights continues to evolve as a trusted educational resource, combining our signature retro aesthetic with cutting-edge financial content. We remain committed to our mission of making financial knowledge accessible to all.

Our Educational Approach

The Circular Learning Model

Our educational content follows a circular learning model that connects different aspects of financial knowledge, making it easier to understand how various concepts relate to one another.

This approach recognizes that financial understanding isn't linear but interconnected. For example, understanding blockchain technology is enhanced by knowledge of traditional banking systems, just as investment strategies are better appreciated with an understanding of market analysis.

By creating these connections, we help our audience build a more comprehensive understanding of finance as an ecosystem rather than isolated topics.

Educational Content Pillars

Financial Fundamentals

Educational materials on core financial concepts, principles, and practices that form the foundation of financial literacy and understanding.

Technology Insights

Explorations of how technology is transforming financial services, from blockchain and AI to digital banking and beyond, presented in accessible language.

Historical Context

Connecting today's financial landscape with its historical roots to provide perspective on how financial systems and technologies have evolved over time.

Why the Retro Aesthetic?

Our distinctive 80s-inspired visual identity isn't just a stylistic choice—it serves several important purposes in our educational mission:

Cognitive Benefits

Research suggests that distinctive visual presentations can enhance information retention. By pairing financial concepts with memorable retro aesthetics, we create stronger cognitive associations that help our audience remember what they've learned.

Historical Perspective

The 1980s was a transformative era for financial services, marking the beginning of widespread computerization in finance. Our retro aesthetic serves as a reminder of this pivotal period while we discuss contemporary innovations.

Accessibility

By wrapping complex financial information in a visually engaging package, we make the content more approachable and less intimidating, especially for those new to financial concepts.

Distinctiveness

In a world of similar-looking financial websites, our unique visual identity helps us stand out and creates a memorable experience for our audience.

Who We Serve

Students

Those studying finance, economics, or related fields who want supplementary educational materials presented in an engaging format that complements their formal education.

Professionals

Working individuals from various industries who want to enhance their financial literacy or stay informed about innovations in financial technology that might affect their field.

Curious Minds

Anyone with an interest in better understanding financial concepts, whether for personal knowledge, career development, or simply to be a more informed citizen in today's complex economic environment.

Our Commitment to Education

RetroFinance Insights is committed to providing high-quality, educational content that empowers our audience with knowledge about financial concepts and technologies. We believe that financial literacy is a fundamental skill in today's world, and we're dedicated to making that knowledge accessible to everyone, regardless of their background or prior experience with financial topics.

While we provide information about various financial technologies and concepts, our content is purely educational in nature. We do not offer financial advice, investment recommendations, or any services that would require regulatory oversight. Our goal is simply to help our audience better understand the evolving world of finance through engaging, informative content.

Looking Forward

As we continue to grow, RetroFinance Insights remains dedicated to our core mission of providing accessible financial education with our unique retro approach. Our vision for the future includes:

Expanded Content

Developing more in-depth educational resources on emerging financial technologies and fundamental concepts to serve our growing audience's diverse interests.

Global Perspective

Broadening our coverage to include more international financial systems and technologies, recognizing the increasingly global nature of finance.

Enhanced Learning

Exploring new formats and technologies to make our educational content even more engaging and effective for different learning styles.

We're excited about the future of financial technology and education, and we look forward to continuing our journey of making financial knowledge accessible, engaging, and relevant for everyone.